By proactively managing material climate change risks and opportunities, both physical and transition, we seek to create long-term value for our investments and stakeholders. CVC continues to evolve its understanding of the transition and physical risks both in our own operations and in our portfolio.

CVC is committed to helping accelerate the energy transition and proactively managing the impacts of this on our portfolio. We believe that reducing our own greenhouse gas (GHG) emissions footprint and engaging with our portfolio to do the same creates long-term value for our portfolio companies and stakeholders.

Science Based Targets initiative (SBTi)

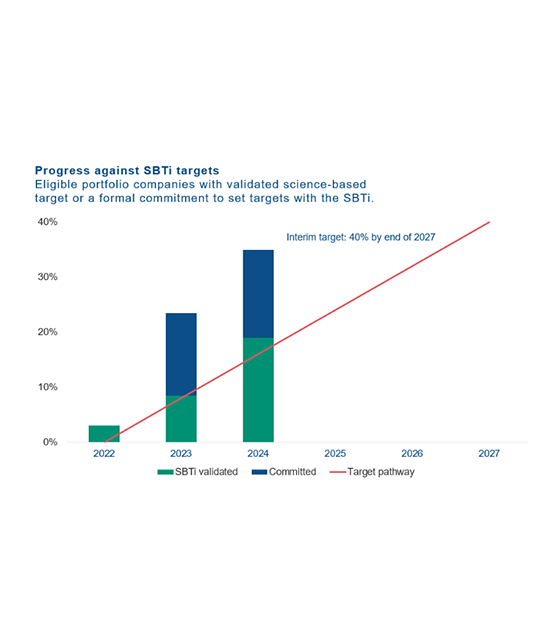

In 2022, when our business consisted of the Private Equity and Credit platforms, we set Science Based Targets initiative (SBTi) targets which, if met, will contribute to the objective of limiting global warming to 1.5°C, in line with the Paris Agreement. The targets were approved by the Board of CVC and validated by the SBTi in 2023.

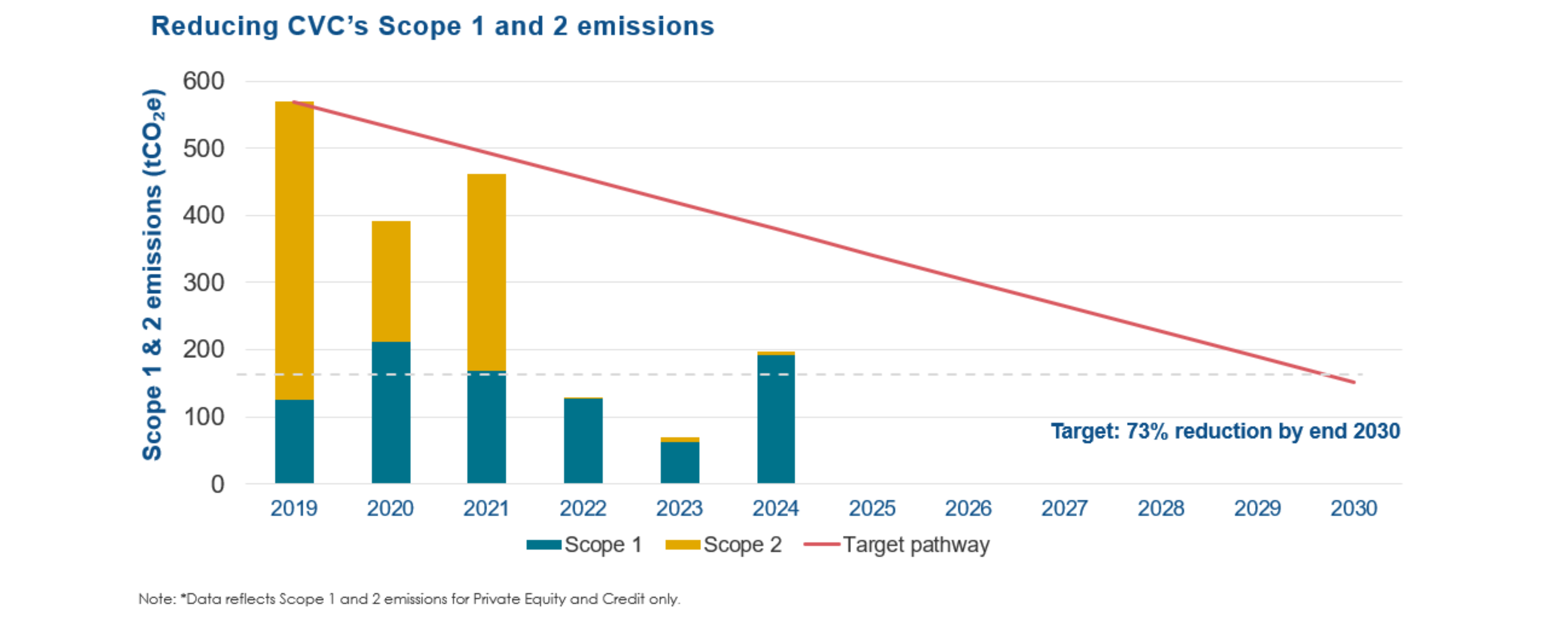

Scope 1 and 2: CVC commits to reduce absolute Scope 1 and 2 GHG emissions in the operations of our Private Equity and Credit strategies by 73% by 2030 from a 2019 base year.

Portfolio Targets: CVC commits to 40% of its eligible private equity and listed equity investments in the Private Equity strategy by invested capital setting SBTi validated targets by 2027, and 100% of its eligible private equity and listed equity investments by invested capital setting SBTi validated targets by 2035.

CVC DIF, our Infrastructure strategy has set a target to achieve net zero across its portfolio by 2050 (interim target of 70% aligning by 2030) using the Net Zero Investment Framework (NZIF) and associated guidance from the Institutional Investors Group on Climate Change (IIGCC).

Operational emissions

Our direct and indirect operational emissions (Scope 1 and 2) are predominantly the result of the running of our offices. We aim to reduce these emissions by:

- Procuring renewable energy, or purchasing Energy Attribution Certificates for sites that do not procure renewable energy

- Electrifying our vehicle fleet

- Considering energy efficiency in new leases

By purchasing renewable electricity, we have significantly reduced our Scope 2 emissions and plan to do the same in future years.

The increase in Scope 1 and 2 emissions in 2024 is primarily due to the inclusion of refrigerant-related emissions, improving the completeness and accuracy of our data.

Portfolio emissions

Emissions from our investment portfolio account for the vast majority of our GHG emissions footprint. We are therefore prioritising the decarbonisation of our portfolio, with a particular focus on our Private Equity and Infrastructure portfolios, where we have the most influence to effect change. In our role as manager and adviser to the funds’ investment portfolios, we encourage investee companies to improve the quality and accuracy of the climate data they report and set decarbonisation targets where relevant, and where there is the opportunity to do so.

CVC Planet and People Grants

We award People and Planet Grants to CVC's portfolio companies to accelerate progress on projects that have positive social and environmental impacts.

During the programme, our portfolio companies gain insights that they can share across the network to widen the reach of the projects.