2024 was a landmark year for CVC, in which we successfully completed our IPO, delivered continued growth and made significant strategic progress.

Rob Lucas Chief Executive Officer

Annual Report & Accounts 2024 Downloads Centre

Download key sections of our Annual Report & Accounts 2024 and related documents here.

Annual Report & Accounts 2024

Annual Report & Accounts 2024 - ESEF

Highlights of the Year

CEO Review

Our Approach

Our Strategies and Performance

Financial Review

Risk Overview

Governance Report

Sustainability Report

Financial Statements

Additional Information

Strong performance in 2024

€ 0 m

Statutory Total Revenue

€ 0 m

Statutory EBITDA

€ 0 m

Statutory Profit After Tax

€ 0 m

Adjusted Pro Forma Total Revenue1

€ 0 m

Adjusted Pro Forma EBITDA1

€ 0 m

Adjusted Pro Forma Profit After Tax1

In addition to the statutory financial results, the Group presents pro forma financial information that reflects the results of the Group as if the Pre-IPO Reorganisation and the acquisition of CVC DIF had been completed on 1 January 2023. The Group also presents adjusted measures that help to illustrate the underlying operating performance of the Group.

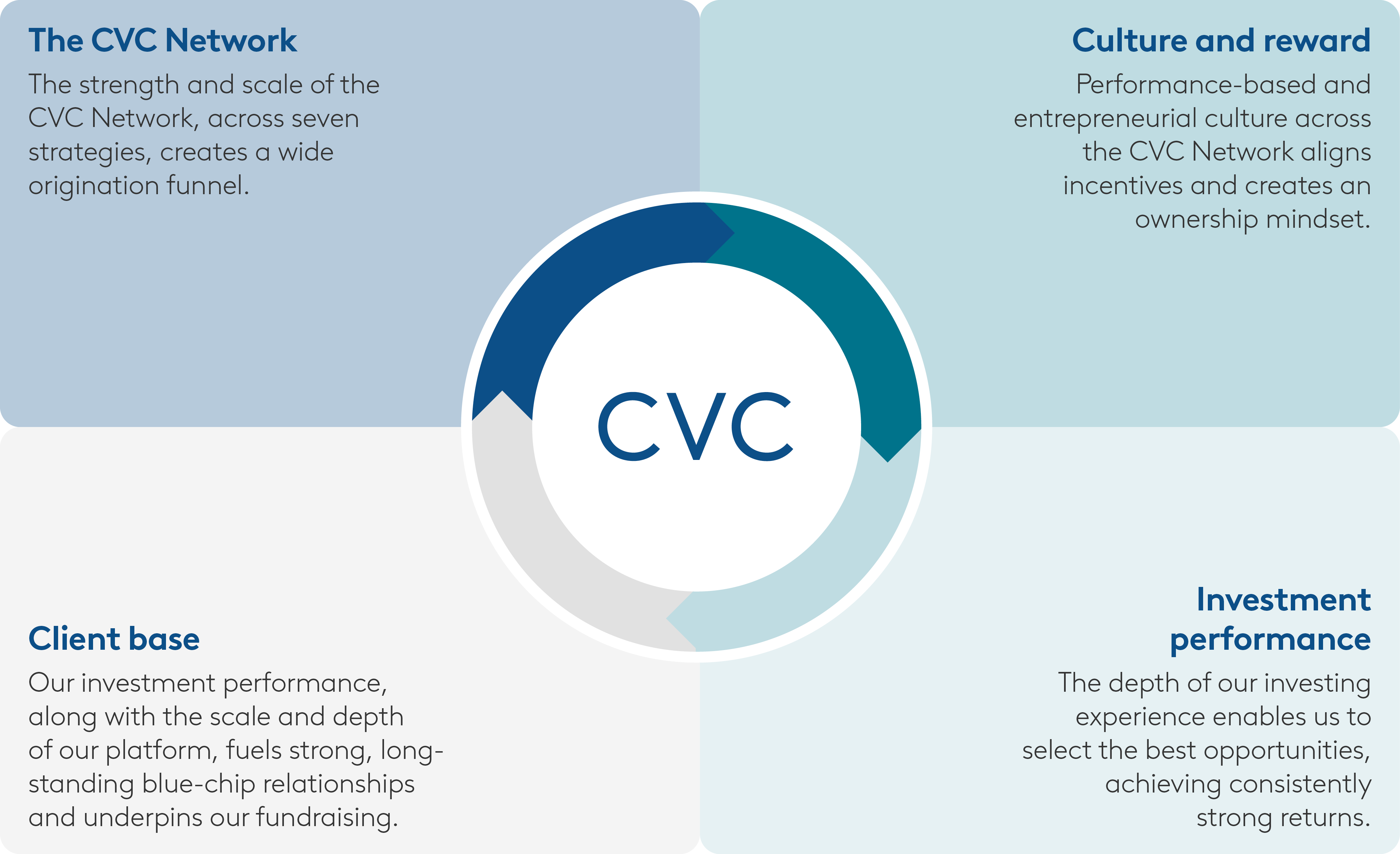

What makes CVC successful?

The CVC Network, our unique culture, investment performance and client base underpin our success.

Seven complementary investment strategies

One integrated platform managing €200bn of AUM2

Europe / Americas

Global leader – able to deploy at scale, and consistently performing across multiple cycles.

1996 Launch yearAUM2

Investment professionals3

CVC's Europe/Americas private equity strategy is focused on control or co-control investments in market-leading businesses across these regions

Europe / AmericasAsia

Regional strategy supported by strong long-term market trends.

1999 Launch yearAUM2

CVC has one of the largest and longest-established pan-regional office networks of any private equity business in Asia and has been active in the region since 1999

AsiaStrategic Opportunities

Complementary lower-risk, longer-hold strategy, with flexible investment approach.

2014Launch year

AUM2

CVC established its Strategic Opportunities strategy in 2014 to invest in high-quality businesses that may not suit a traditional private equity mandate

Strategic OpportunitiesCatalyst

Mid-market private equity investment strategy.

2025Launch year

AUM2

CVC Catalyst is CVC’s mid-market private equity investment strategy.

CatalystSecondaries

Providing tailored liquidity solutions for third-party GPs and LPs.

2006 Launch yearAUM2

CVC Secondary Partners manages and advises five active secondary flagship funds, investing primarily in Europe and North America with a mid-market focus.

SecondariesCredit

Leading global provider of corporate credit solutions.

2006 Launch yearAUM2

CVC Credit invests in companies across the sub-investment grade corporate credit markets in Europe and North America, with a track record of sourcing, underwriting and managing risk.

CreditInfrastructure

Investing specifically in core, core+ and value-add infrastructure

2005 Launch yearAUM2

Investment professionals4

Founded in 2005, CVC DIF (formerly DIF Capital Partners) is an infrastructure fund manager with a leading position in managing mid-market investments, primarily in Europe, North America and Australia.

InfrastructureSustainability

CVC sees sustainability as an important part of our approach to value creation and risk management to build better businesses and create sustainable value for our stakeholders. We believe this contributes to the long-term success of our business and the investments we make.

Case Studies

CVC's ability to bring to bear the full extent of its global resources on any situation gives it a competitive advantage when creating value during CVC's ownership period.

1. Adjusted measures (including pro forma information) are alternative performance measures (APMs) and are unaudited.

2. Including parallel vehicles to the main funds.

3. Europe / Americas total includes Technology investment professionals, which are also included in Growth.

4. Acquisition of CVC DIF closed on 1 July 2024.

Note: for information purposes only. As at 31 December 2024. Totals may not sum due to rounding.